December closed out the year with a familiar but evolving theme across the Greater Toronto Area: measured pricing adjustments paired with selective buyer engagement. Across Toronto, Mississauga, Oakville, and Burlington, sales volumes generally softened month over month, reflecting typical seasonal slowdowns, while pricing performance varied notably by housing type and location.

While borrowing costs have improved compared to earlier in the year, December activity confirms that many buyers remained deliberate as the holiday season approached, prioritizing value and long-term fundamentals. Sellers who aligned pricing with current market conditions continued to transact, while others encountered longer timelines. Overall, the market entered 2026 in a more balanced position, supported by improved affordability relative to peak levels and steady underlying demand.

Below are our key takeaways on month-over-month activity between November and December 2025:

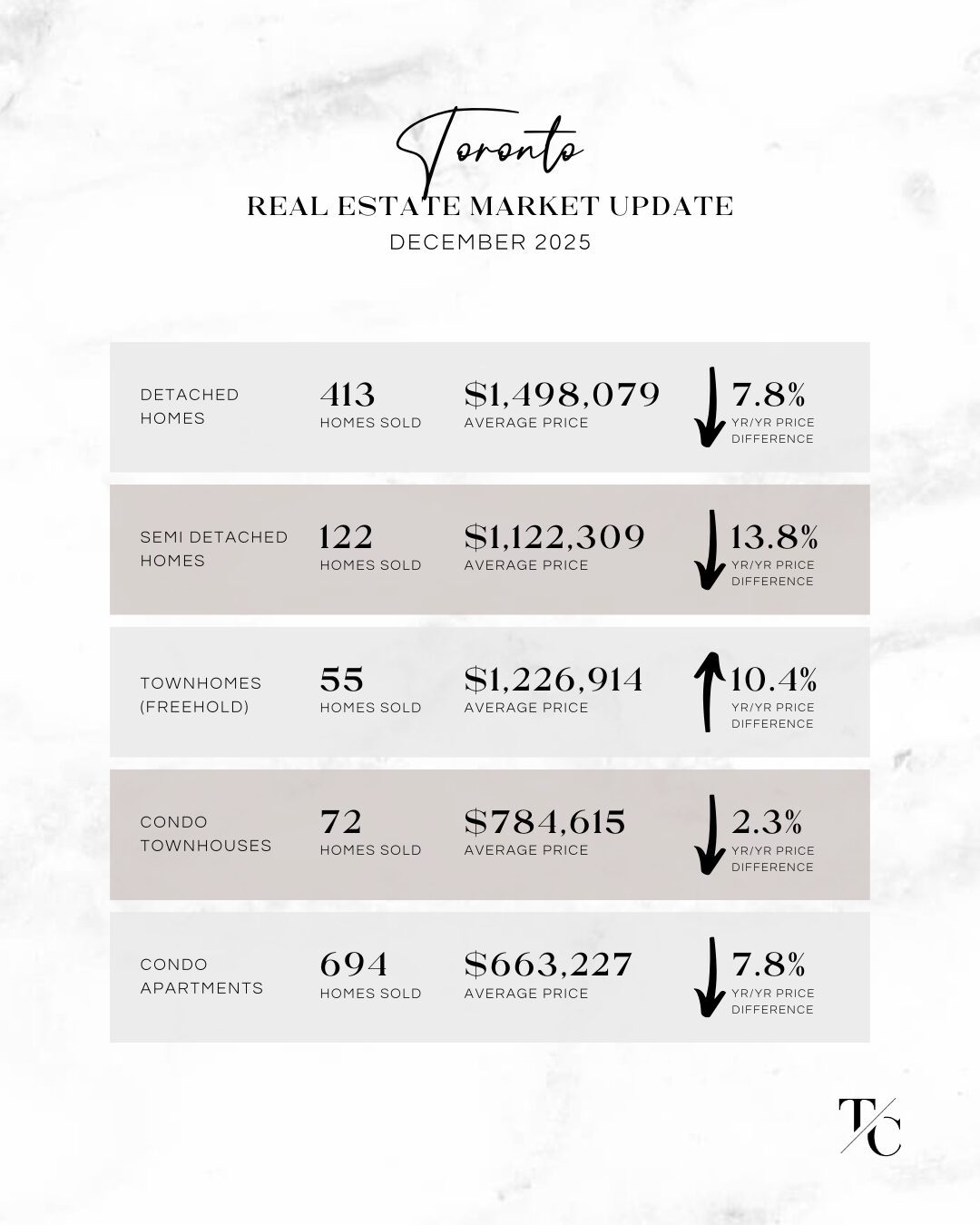

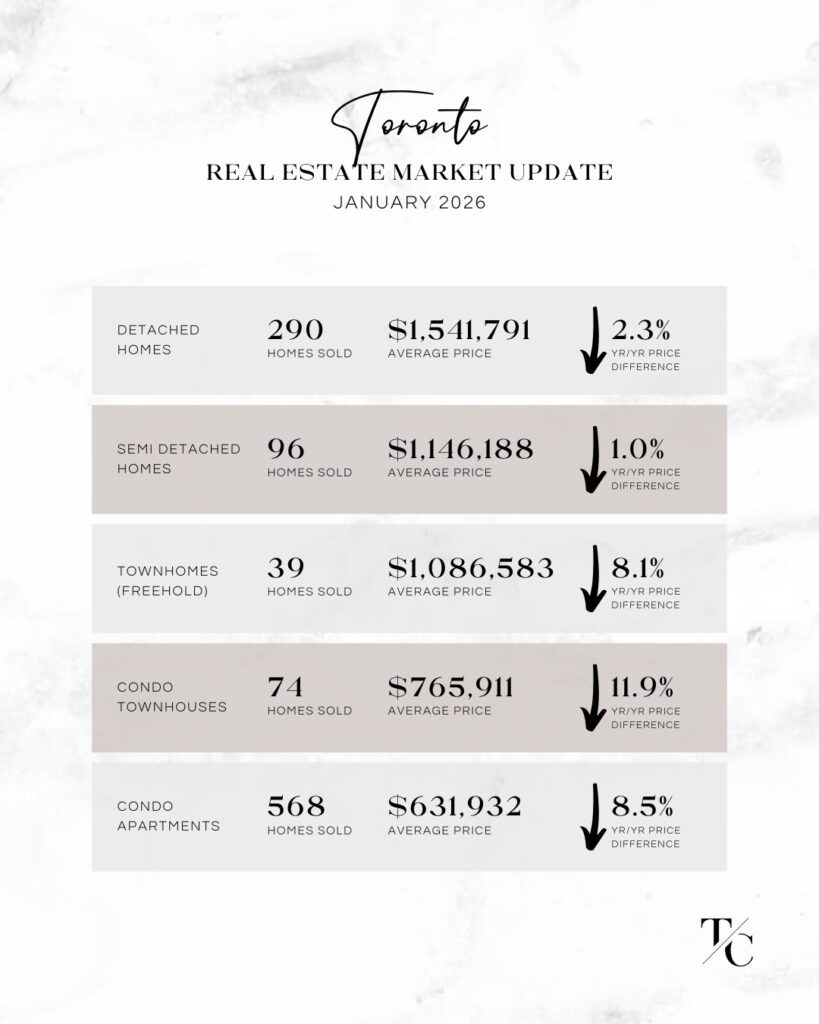

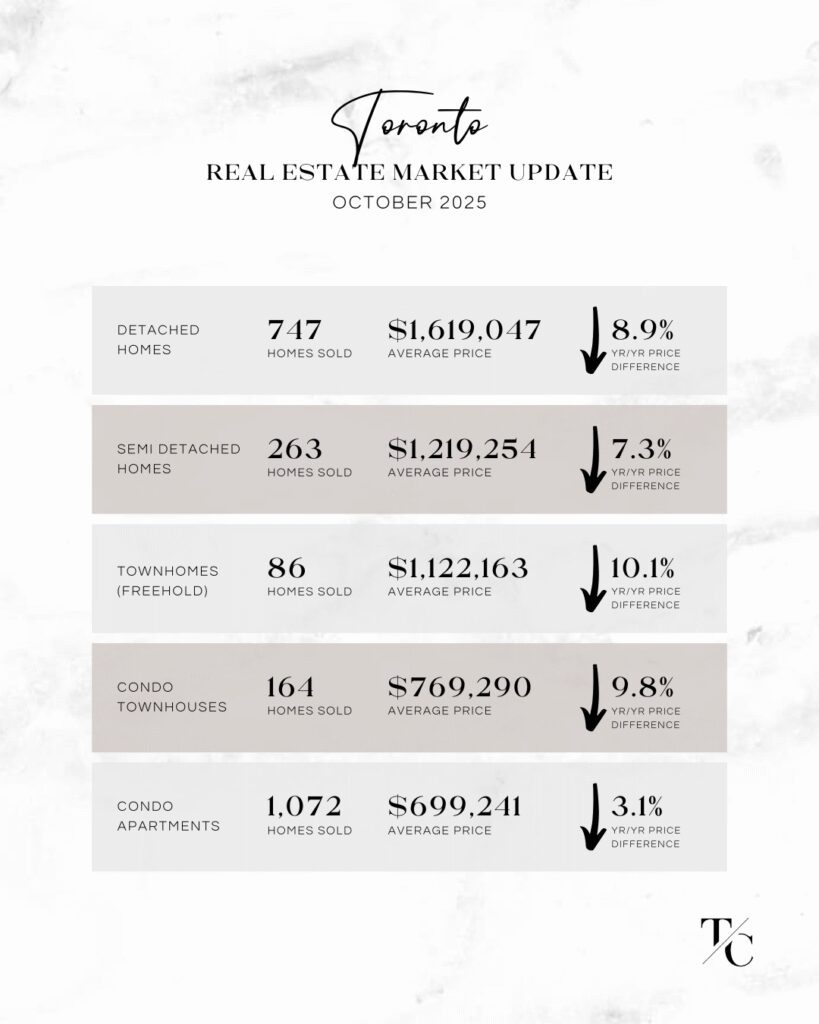

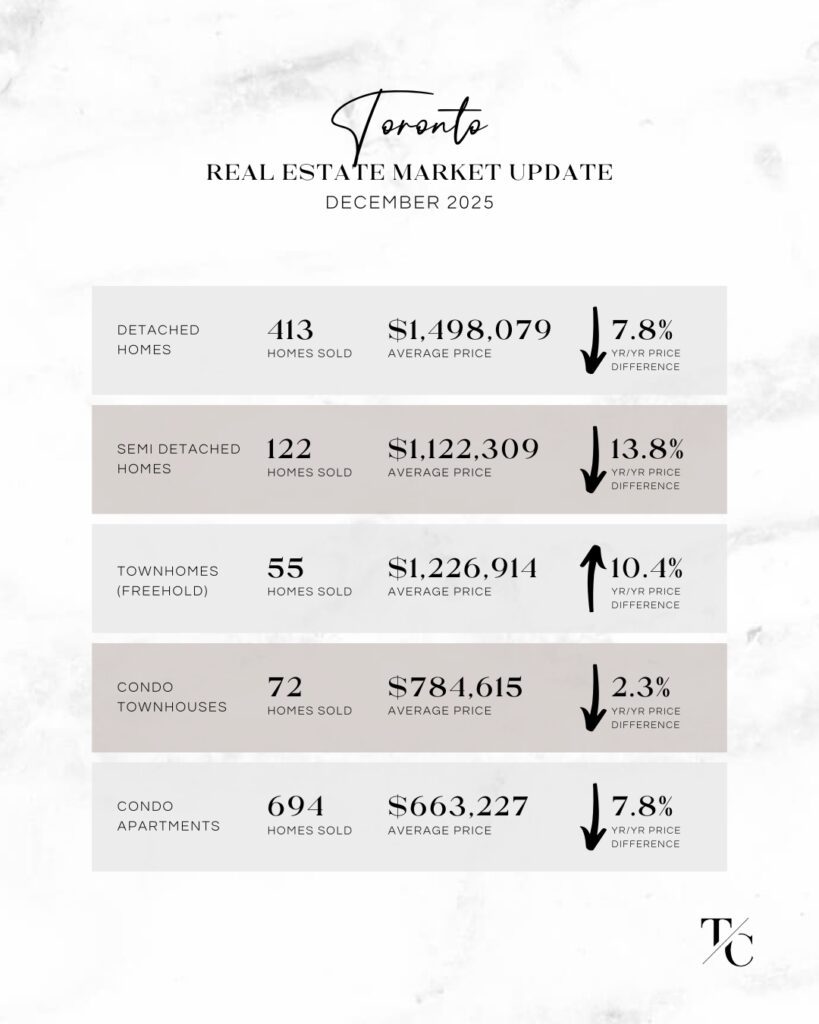

◼️ Toronto saw continued moderation in December. The average detached home price declined by approximately $48,000 month over month, alongside 187 fewer sales, reinforcing the seasonal pullback in activity. Semi-detached prices eased by about $65,000, with sales down by 87 units. In contrast, freehold townhouses recorded a notable rebound, with average pricing rising by roughly $158,000, despite 19 fewer sales. Condo townhouses experienced a modest price increase of $22,000, while condo apartment pricing declined by approximately $38,000, with sales dropping sharply as expected for December. Year over year, most Toronto segments continued to reflect price declines, though the pace appears to be stabilizing.

◼️ Mississauga activity softened across nearly all segments in December, however the most consistent and stabilized of the areas in our report – essentially flat on the month over month activity. The average detached home price increased modestly by $19,000 month over month, while sales declined by 23 homes. Semi-detached pricing declined by approximately $16,000, with a significant reduction in sales volume. Freehold townhouse pricing fell by about $20,000, while condo townhouses edged higher by roughly $7,000, supported by a meaningful increase in sales activity. Condo apartments declined by approximately $16,500, with fewer transactions. Overall, Mississauga continues to demonstrate relatively resilient pricing compared to other GTA markets, particularly for detached homes.

◼️ Oakville displayed mixed results in December. The average detached home price declined sharply by approximately $176,700 month over month, accompanied by 49 fewer homes sold, reflecting seasonal dynamics and increased price sensitivity at higher price points. Semi-detached pricing rebounded, rising by about $58,000; however, sales activity remained extremely limited, with only 6 semi-detached homes sold during the month. The most significant increase was seen in freehold townhouse pricing, which rose by nearly $294,000, clearly driven by higher-quality transactions. Condo townhouse pricing increased by approximately $71,500, while condo apartment prices remained essentially flat. Despite short-term volatility, Oakville continues to present compelling opportunities for buyers focused on long-term value. With the exception of detached homes, pricing increased across all housing categories compared to the prior month.

◼️ Burlington experienced modest pricing resilience in December. The average detached home price declined by approximately $66,700 month over month, with 13 fewer homes sold. Semi-detached home values increased by over $103,000, despite very limited sales with only 7 homes sold, highlighting the impact of low transaction volumes. Freehold townhouse pricing rose slightly by about $7,800, while condo townhouses declined by approximately $101,700. Condo apartment pricing declined by about $101,000, reversing November’s strength in that segment. Burlington remains a market where pricing remains relatively stable year over year, supported by consistent end-user demand.

As we enter the new year, the market remains defined by choice, patience, and strategic opportunity. Buyers who focus on fundamentals rather than short-term fluctuations are well positioned, while sellers who align pricing and presentation with today’s conditions continue to see results.

Do you have questions about the market?

Fill in a few details to get in touch today.