In the current market, many people have their eye on buying their first home. With a long-term trend of rising real estate prices, owning real estate as soon as you can is a wise and sensible investment.

Achieving this exciting milestone at any age requires planning, and expert guidance can go a long way to a successful outcome. In our ‘Everything You Need To Know As A First-Time Buyer’ post, we’ll provide some valuable advice on how to buy your first home in Toronto or the west GTA.

With the right guidance, buying a home can be a seamless and enjoyable process. Learn more by reviewing our Buyer’s Guide right here.

Is It Time to Say Goodbye to Renting?

Renting can make sense as a first option when moving from a family home, or if you’re new to an area and do not want to make as permanent a commitment to a property whether based on relocating for business or personal. It can be good for getting a feel for a particular neighbourhood or type of property. It can also provide the ability to pick up and move with very little notice.

Financially speaking, being a tenant may not be the best use of your resources. In fact, it may be possible to own a home for approximately the same amount that you spend on rent.

Instead of paying down someone else’s mortgage, why not consider the benefits of owning instead of renting? When you think about how much rent is in Toronto and the west GTA, and what that amounts to on an annual basis, it can be eye opening as to how much you’ve spent on something that you don’t own. You’re paying down the landlord’s mortgage, instead of the upside of paying down your own.

When you own your home, your equity will grow as real estate values rise. Over the years, owning a home can set you up for a level of financial stability that you can likely not achieve when paying rent each month.

Keep Your Goal in Mind

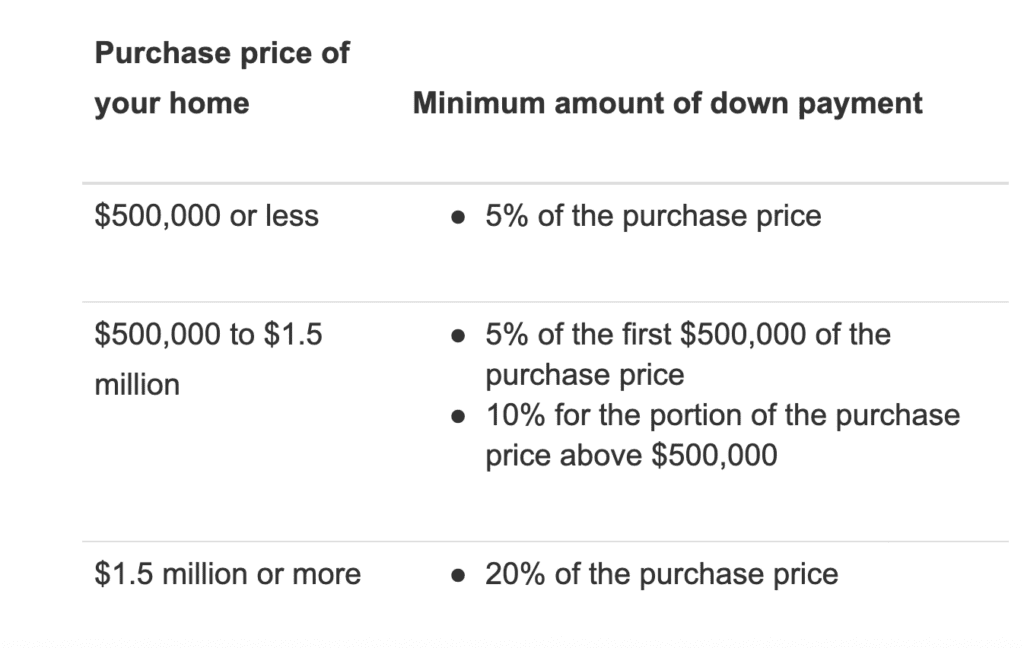

Real estate in Toronto and the west GTA is a valuable asset, and buying a home requires an initial upfront cost with a down payment and deposit. This doesn’t have to be intimidating. In fact, the government has implemented recent measures to make a first time purchase more attainable for buyers with a smaller down payment.

For example, previously, a first time buyer would have required a 20% purchase price on a purchase amount over $1,000,000. Today, a first time buyer can buy up to $1,500,000 with less than 20% down.

This government incentive provides for a greater opportunity for a first time buyer to be able to afford getting into home ownership. Note that if buying with less than 20% down, the mortgage will require mortgage loan insurance however it’s a small price to pay (that is factored into your monthly payments) in becoming a property owner. More on the cost of mortgage loan insurance can be found here.

Depending on your income/debt ratio and the purchase price, it is possible to buy a property with as little as 5% down. For example: a purchase price of up to $500,000 may provide for as little as a 5% downpayment. On the amount from $500,000 – $1,500,000 a minimum 10% down payment would be required. A purchase price over $1,500,000 will require a minimum 20% down payment.

First Time Buyer Down Payment Chart

Resources for First-Time Home Buyers

The expenses of buying your first home can seem endless. Fortunately, there are federal and provincial government programs designed to help you. At the Tanya Crepulja Team, we are happy to walk you through all tools and resources that could be available. Below are a few examples:

First Home Savings Account: You can save up to $8,000 per year up to a maximum of $40,000 in a special investment account just for buying your first house. Best of all, any dividends your account earns can also go toward your purchase. We have created a detailed explanation of this incentive here in a separate blog post.

Home Buyer’s Plan: Have you been diligently saving for retirement? The Home Buyer’s Plan allows you to withdraw as much as $60,000 from a registered retirement savings account to cover some of the costs of your first home. These funds will need to be repaid within 15 years to avoid a tax penalty.

Land Transfer Tax Rebates: Land transfer taxes can be significant, especially in Toronto where there is an additional municipal tax. The provincial rebate can save you up to $4,000 as a first-time buyer, while the municipal rebate offers up to $4,475 when buying your first home in Toronto.

First Time Home Buyer Tax Credit: You can claim $10,000 on your tax return for the year you purchase a qualifying property. This reduces the amount of your taxes by up to $1,500.

New HST Rebate Proposal for First-Time Buyers of New Homes (Ontario)

Recently, the Ontario government announced a proposal intended to ease the financial pressure for first-time buyers purchasing newly built/pre-construction homes. This change significantly increases the Ontario New Housing Rebate, allowing eligible first-time buyers of pre-construction homes to receive a full rebate on the provincial portion of the HST on a purchase price of up to $1,000,000, and a partial rebate of balance up to $1,500,000.

For many buyers, this could reduce upfront costs and make entering the market more accessible. While details are still being finalized, it’s an important development to watch if you’re considering a new build, particularly as deposit structures and construction timelines already support a more gradual path to ownership.

Refining Expectations

It will also help to have realistic expectations about your first home. The goal isn’t necessarily to move straight into a luxurious estate; you simply want to take your first step onto the property ladder.

Like buying your first car, purchasing a house should be an exciting and memorable experience, but it will not likely be your last. Many people will move several times throughout the course of their lives. The equity you gain from your first property makes it all possible.

Looking for even more tips to help you as a first-time home buyer? Don’t miss the related reading below:

- A Complete Guide To Relocating To Toronto And The West GTA

- Should You Rent Or Buy In Today’s Market?

- 7 Things To Think About When Looking For A Home

Arranging Your Finances

Saving for a down payment is a vital step to buying your first home. Start by setting a goal for how much you want to save. If you want to move in by a particular date, use our buyer calculator to determine how much you will need in your bank account to make it happen.

The purchase price of your home is only part of the story. You will also need to set aside some funds to cover your closing costs, such as land transfer taxes, legal fees, and mortgage insurance. In addition, be sure to budget for your moving expenses, especially if you plan on hiring professional movers. To comfortably close on your new property, it is ideal to cushion your home-buying budget by keeping an extra amount of 4% to 5% of the purchase price aside for the closing costs.

Before you start viewing potential properties, take the time to get a mortgage pre-approval. This is an essential first step before starting the home buying journey. You’ll want to know how much you can qualify for, and this will also provide you with insight on affordability and what you can anticipate your monthly mortgage payments to be. It will also aid you in setting a realistic budget range for your goals. Having a mortgage pre-approval in place also becomes a powerful negotiating tool that shows sellers that you are a serious buyer.

What Type of House Is Right for You

Clarifying your budget will guide you as you create the vision of the home you want. One of your first decisions comes down to structure and style based on what you can afford and the amount of upkeep you are willing to take on. For example, should you buy a condo, townhouse, or a detached house?

Once again, your initial purchase price is only the beginning. If you buy a detached home or a freehold, you will want to keep some funds available for maintenance and repairs. Condos require less personal upkeep; however, it’s important to factor in any applicable condo fees. Throughout the process, weigh your options based on your financial picture and your goals.

Know Your Market:

Where would you like to live in Toronto or the west greater Toronto area?

Determining your location is one of your first tasks as you embark on this journey of buying your first home. It’s important to find a city and neighbourhood and area where you can not only comfortably afford, it should be an area where you’ll feel good living in and provide the lifestyle you want.

Access to public transit, walkability, and proximity to work, family, and friends are all factors to consider. With that in mind, let’s take a closer look at Toronto and the west GTA, and all this exciting region has to offer.

Toronto proper encompasses Downtown/Central, Midtown, Uptown, East and West (not to mention the more suburban boroughs of the city like, Etobicoke, North York and Scarborough). Each of these areas has a culture and personality all of its own. The closer you are to the downtown core, generally becomes more expensive which can push the budget for some first-time buyers, unless you’re in the market for a condo – where there would be ample selection across not only downtown, but also various other parts of the city.

If you want to expand your options, west GTA cities like Mississauga, Oakville, Milton, Burlington, Waterdown and vicinity deserve your attention. Each of these locations has unique character and charm, as well as a variety of price points and home structures.

We’ll take the time to do a deep dive into your home buying goals to determine which area would be the best fit based on your lifestyle, amenities, commute to work, proximity to friends and family, nearby parks and recreation, great schools (if applicable for those with a family). Wherever you decide, together we’ll find the perfect home where you can enjoy and look forward to residing in for the years to come.

Planning your purchase begins with finding a neighbourhood where you will feel right at home. The posts below can help you narrow down your best options:

- How Toronto Compares To International Cities

- Our Top Family-Friendly Mississauga Neighbourhoods to Call Home

- The Joy Of Oakville Living for Families

- 10 Up-And-Coming Neighbourhoods For Investment In Toronto

The Elevated Concept of Time in Market

Many hopeful home seekers prefer to buy when prices hit the bottom. Since the market is unpredictable, this isn’t always the best approach.

Here’s a higher-level way of thinking about it. Consider your “time in the market” rather than simply trying to “time the market.” The best way to illustrate this concept is through an example.

Imagine you buy a house for $500,000. A few months later, the market undergoes a correction, and now your home is valued at $495,000. On paper, it seems as though you’ve lost $5,000. However, savvy buyers look at the big picture, not the minor fluctuations.

Years later, your property will appreciate even though short-term values might drop. If your property is one day worth $600,000 a decade after your purchase, will you be concerned with a short-lived $5,000 decrease in value?

Long-term equity growth enables you to forget any initial ups and downs in the real estate market. This financial potential is an excellent reason to buy your home as soon as you’re ready and able.

What’s your next step after getting the keys to your first home? The posts below will inspire you to make it your own:

Partner With an Expert

A caring and knowledgeable real estate agent like Tanya Crepulja will guide you through every step. We will also advocate for your best interests and negotiate the best price and terms for your purchase. We want you to have the absolute best home buying experience, from the beginning stages to when you receive the keys to your new home. Treating your purchase like our own, we will explore opportunities in different locations and structures that fit your real estate home buying goals.

Our goal is to find the best property for you, and together, we’ll make your real estate home buying dreams a a reality. Connect with us today at tanya@tcteam.ca or call 647-293-3785 for a confidential conversation to get started on your journey!